The second Apple stock split took place on 21 June 2000, and was also a two-for-one split. Ahead of the split in May 2000, the stock price was $84. Shortly afterwards though, in September 2000, share prices were halved as many technology companies experienced a rapid decline.

This was around the time the dot-com bubble burst, where many companies went out of business and others decreased in value. Apple blamed lower-than-forecast sales, as well as a weaknesses in the education market. While Apple was affected temporarily, the company's shares made a full recovery and went on to achieve new highs. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

Since 1988 it has more than doubled the S&P 500 with an average gain of +25.25% per year. These returns cover a period from January 1, 1988 through December 6, 2021. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.

Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. Traditional preferred stock, trust preferred securities, third-party trust certificates, convertible securities, mandatory convertible securities and other exchange-traded equity and/or debt securities. Criteria and inputs entered, including the choice to make security comparisons, are at the sole discretion of the user and are solely for the convenience of the user.

Analyst opinions, ratings and reports are provided by third-parties unaffiliated with Fidelity. Fidelity does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities. Fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide any warranties regarding results obtained from its use. Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company serves consumers, and small and mid-sized businesses; and the education, enterprise, and government markets.

It distributes third-party applications for its products through the App Store. The company also sells its products through its retail and online stores, and direct sales force; and third-party cellular network carriers, wholesalers, retailers, and resellers. Apple Inc. was incorporated in 1977 and is headquartered in Cupertino, California. Apple's first stock split occurred on 16 June 1987, seven years after it became a public company, and it was a two-for-one stock split. It kept share prices low enough to make them accessible to investors.

There was a 2% rise in stock prices over the following year. Apple Inc. designs, manufactures and markets smartphones, personal computers, tablets, wearables and accessories, and sells a variety of related services. The Company's products include iPhone, Mac, iPad, and Wearables, Home and Accessories. IPhone is the Company's line of smartphones based on its iOS operating system. Mac is the Company's line of personal computers based on its macOS operating system.

IPad is the Company's line of multi-purpose tablets based on its iPadOS operating system. Wearables, Home and Accessories includes AirPods, Apple TV, Apple Watch, Beats products, HomePod, iPod touch and other Apple-branded and third-party accessories. AirPods are the Company's wireless headphones that interact with Siri. Its services include Advertising, AppleCare, Cloud Services, Digital Content and Payment Services. Its customers are primarily in the consumer, small and mid-sized business, education, enterprise and government markets. It seems unlikely that Apple will complete another stock divide in the near future.

Share prices are still climbing (they are currently trading at around $186), however shares were worth close to $700 before the last split in 2014. Apple may consider another stock split if share prices continue to rise, but for now, this move probably wouldn't be in the best interests of the company. When looking at the value of a company's shares, it can be difficult to interpret how successful the company has been based on its stock prices following a split. Apple's current share price of around $408 doesn't look as impressive as it would have done ahead of its four stock splits. To understand and analyze the movement of Apple stock prices, you can see our price history table and real-time share prices above.

StockInvest.us is a research service that provides financial data and technical analysis of publicly traded stocks. All users should speak with their financial advisor before buying or selling any securities. Users should not base their investment decision upon StockInvest.us. By using the site you agree and are held liable for your own investment decisions and agree to the Terms of Use and Privacy Policy.Please read the full disclaimer here. Apple stock price history chart shows how new iPhone release Changed apple stock price over the time.

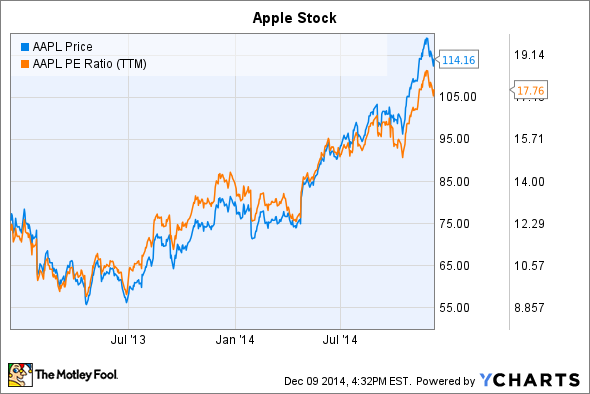

Apple's fourth and final stock split to date happened on 9 June 2014. This was the most significant of Apple's stock splits, with a seven-to-one ratio taking shares from close to $700 down to around $100. Apple wanted to make shares accessible to more investors, but it's also speculated that they set their sights on inclusion in the Dow Jones Industrial Average index. This index acts as a benchmark, with 30 stocks included from key economic sectors. As it's a price weighted average, Apple's stock price needed to be reduced before it was feasible for the company to be added.

It was announced that Apple would join the Dow Jones in March 2015 and it has been a part of the index since March 2019. Apple's financial performance, including its share price, relies heavily on the sales of its products. A high flier through much of its recent history, Apple stock hit new all-time highs toward the end of 2021, with a market capitalization approaching a record $3 trillion.

Apple stock rose by 0.9% in trading this morning, but closed down 2.1%, at $175.74 per share. Talk of the $3 trillion mark came as JPMorgan updated its target share price for the company from $180 to $210, citing improved expectations around demand for the iPhone 13. In a note, JPMorgan analysts wrote they believed Apple's stock was undervalued, and that the company's upcoming iPhone with 5G technology has the potential to convert more than 1 billion Android users.

An investor buys a share in Apple in January 2005, so they have one share worth $77.00. After the two-for-one stock split a month later, they own two shares in Apple, but each of these shares is worth half the amount, at $38.50. If the shareholder keeps these two stocks until May 2014, they will be worth $1,266 ($633 each) as the stock price appreciates.

With the fourth stock split, each of these stocks will then be split seven times, so that the shareholder owns 14 shares in Apple. Stock divides might not directly increase share prices, but they can often result in higher share prices further down the line. By making shares accessible to new investors, demand can increase, causing the share price to appreciate and the total market capitalisation to rise. While a stock split might be carried out to encourage investment, the split in itself doesn't affect the market capitalisation of a company. Existing shareholders will own more stocks, but each of those stocks is worth less, so there is no change to the total market value of the company. The company has previously split its stock four times when its shares have seen significant price increases, as highlighted in the table below.

In the first three instances, stocks were split in two when the price was near triple figures. Then, in 2014, share prices rose sharply and a higher split ratio was used. A focus of Apple technical analysis is to determine if market prices reflect all relevant information impacting that market. A technical analyst looks at the history of Apple trading pattern rather than external drivers such as economic, fundamental, or social events. It is believed that price action tends to repeat itself due to investors' collective, patterned behavior.

Hence technical analysis focuses on identifiable price trends and conditions. When benchmark price declines in a down market, there may be an uptick in Apple Stock price where buyers come in believing the asset is cheap or selling overdone. You can use Apple intraday prices and daily technical indicators to check the level of noise trading in Apple Stock and then apply it to test your longer-term investment strategies against Apple. Apple appears to be very steady, given 3 months investment horizon. Apple Inc secures Sharpe Ratio of 0.27, which signifies that the company had 0.27% of return per unit of risk over the last 3 months. Our standpoint towards foreseeing the volatility of a stock is to use all available market data together with stock-specific technical indicators that cannot be diversified away.

We have found twenty-seven technical indicators for Apple Inc, which you can use to evaluate the future volatility of the firm. Please makes use of Apple's Risk Adjusted Performance of 0.2011, mean deviation of 1.14, and Downside Deviation of 1.37 to double-check if our risk estimates are consistent with your expectations. Apple's stock has split several times since it first went public in December 1980. The first split came on June 16, 1987, on a two-for-one basis at a pre-split price of $79.

The next split came on June 21, 2000, when share prices reached $111. On Feb. 28, 2005, Apple split its stock again when it hit $90. The company split its stock again on a seven-to-one basis on June 9, 2014, when share prices reached $656. The final stock split came on Aug. 28, 2020, when it split on a four-to-one basis at a pre-split price of $499.23. Apple's third stock split took place on 28 February 2005, with the company once again allocating a two-for-one ratio.

This took the number of common shares authorised from 900 million to 1.8 billion, after shares almost quadrupled in value. Predictive indicators are helping investors to find signals for Apple stock's direction in advance. Even though most predictive indicators are useful for the short-term horizon, it's virtually impossible to predict the unforeseen stock market. For traders with a short-term horizon, predictive indicators add value when properly applied. Long-term investors, however, may find many predictive indicators less useful. There are several ways to analyze Apple Stock price data.

The simplest method is using a basic Apple candlestick price chart, which shows Apple price history and the buying and selling dynamics of a specified period. Many traders also use subjective judgment to their trading calls, avoiding the need to trade based on technical analysis. Companies like Apple must beat collective market expectations of their earnings to positively influence their market capitalization.

It's no accident that they often manipulate their earnings reports to match or beat estimates to artificially enhance their stock prices. As a result, earnings management is highly scrutinized by the Securities and Exchange Commission . While Apple didn't hit the $3 trillion market cap today, its share price remains 200% percent higher than it was prior to the pandemic.

The company plans to release computerized glasses featuring augmented reality technology in 2022, and is developing a virtual reality headset as well. Apple is also working on a self-driving electric vehicle that could be on the market as soon as 2025. Apple's upcoming stock split will see investors issued with four new shares for every one they currently own. These shareholders will continue to own the same proportion of Apple stock, since the company will effectively increase the number of shares in circulation by dividing existing shares in four. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions.

Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. On the other hand, each product had a noticeably positive effect on the stock over a longer period of time. The overarching, long-term view is the one to properly frame your investment decisions on, not day-to-day volatility. Over time, the market mechanism will identify true value in the marketplace. Rely on the wisdom of the masses over the long term, not on the speculators that routinely come and go, thereby letting companies like Apple work for you.

Apple's range of Mac products is another example of wildly successful Apple products. The iMac was released in May 1998, with Apple trading in penny stock territory at $7.58. While it didn't have an immediate impact on Apple stock, Apple traded at $9.22—a mere three months later. Moody's Daily Credit Risk Score is a 1-10 score of a company's credit risk, based on an analysis of the firm's balance sheet and inputs from the stock market. The score provides a forward-looking, one-year measure of credit risk, allowing investors to make better decisions and streamline their work ow. Updated daily, it takes into account day-to-day movements in market value compared to a company's liability structure.

After Apple's first two-for-one stock split in June 1987, shareholders received two shares at a stock price of $41.50 each for their stock which had closed the previous day at stock price of $78.50. You'll find the closing price, open, high, low, change and %change of the Apple Inc Stock for the selected range of dates. The data can be viewed in daily, weekly or monthly time intervals. At the bottom of the table you'll find the data summary for the selected range of dates.

The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. , offers investment services and products, including Schwab brokerage accounts. Its banking subsidiary, Charles Schwab Bank, SSB , provides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons.

As we see from apple earning in 2012, apple stock rose 31% in 2012. Broad market index SPX was up 13.41% during this period. Compiles independent, third-party information highlighting key fundamental and technical data, analyst opinions, stock price movement, earnings data, and industry comparisons. The chart above reinforces the idea that buying AAPL near peaks, as is the case today, has historically led to below average returns. Of course, these averages have still been much better than what an investor would have earned from buying and holding a diversified basket of stocks, like the S&P 500 or even the Nasdaq. APPLE INC - is an American multinational corporation that designs, develops, and sells consumer electronics, computer software and personal computers.

Its best-known hardware products are the Mac line of computers, the iPod music player, the iPhone smartphone, and the iPad tablet computer. The company has 72,800 permanent full-time employees and 3,300 temporary full-time employees worldwide. The market capitalization sometimes referred as Marketcap, is the value of a publicly listed company. In most cases it can be easily calculated by multiplying the share price with the amount of outstanding shares. Thanks to the astronomical rise over the years, Apple split the stock again in June 2014, this time seven-for-one.

Three years later, in 2017, with Tim Cook at the helm and a services business providing a bulk of revenue, Apple's stock price is still steadily climbing. Barchart also offers extensive historical data through Barchart Excel and via API through Barchart OnDemand . Both services provide access to historical market data across stocks, options, indices, futures and currencies.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.